Planning your financial future

Insurance/Pre-Need

Insurance

Faith Community United Credit Union provides valuable insurance at no direct cost to eligible members. We urge members to read the insurance certificate relating to coverage on Loan Protection Insurance through CUNA Mutual Insurance. On joint accounts, the first name on the account is insured. It is important that members update their beneficiaries. Under our Loan Protection & Total Disability Insurance; the balance of the loan is paid in full upon the death of an eligible member up to a maximum of $20,000.00. The first signature on the note is the insured. A death certificate must be presented before insurance claims can be processed.

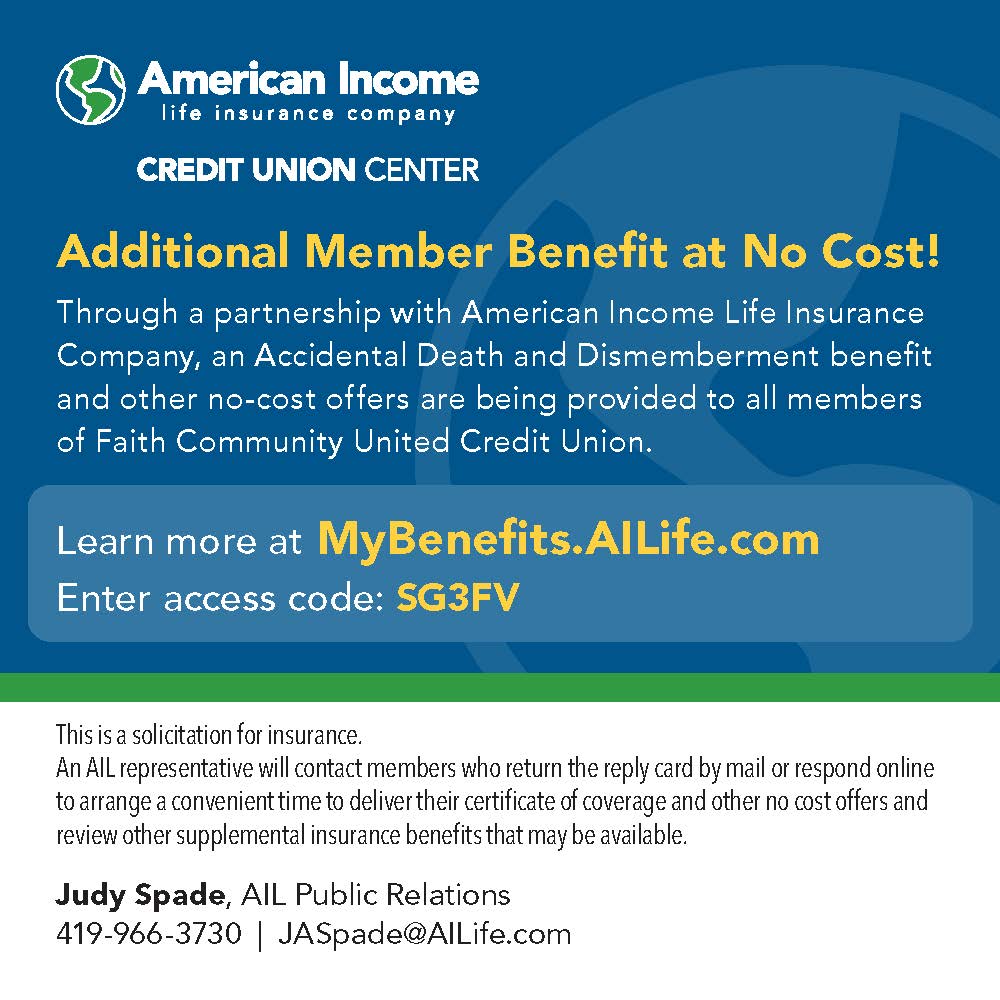

American Income Life Insurance Company automatically offers free Accidental Death and Dismemberment Insurance to all FCUCU members in the amount of $4,000.00. The size of the share balance doesn’t matter. The death certificate must substantiate that the death was accidental.

Members may elect to purchase Credit Disability Insurance on loans at a very low cost per month. With this insurance, monthly payments are made on the loan when a member is ill or injured and unable to work for over 14 days, up to a maximum of $30,000.00. Because we participate in the Direct Insurance Program (Member-Connect), our members have the opportunity to purchase additional types of insurance (homeowners, auto, etc) through CUNA. For a free quote, call (888) 380-9287. Premiums can be automatically deducted from the members’ accounts.

Borrowers are required to purchase their own insurance for collateral pledged on a loan, such as an automobile or home, with the Loss Payable Clause made to Credit Union.

An important coverage is the Bond carried on the full Official Family, providing Directors and Officers Liability and Casualty insurance on financial records, equipment and furnishing.

Deposit Insurance is held on each and every account of an individual in the Credit Union up to $250,000.00 through American Share Insurance (ASI), the nation’s largest private deposit insurer, not an agency of the Federal Government. ASI is owned by credit unions, not risk-taking Wall Street investors, and only insures Credit unions. Currently 1.5 million members belong to credit unions insured by ASI. No credit union member has ever lost money in any ASI-insured credit union account.

Pre-Need Funeral Account

Members may choose to fund a pre-need savings account, naming a designated funeral home to be paid the amount in the account as well as insurance at the time of death. This is especially useful for members who have no immediate family and want to make sure their funeral proceeds based on the arrangements they made before death.

Irrevocable Pre-need Accounts are available to all funeral homes in the city with FCUCU. Community minded funeral homes are pleased to establish these trust accounts, as we are a minority owned faith based community development credit union in their area. Having a third party involved in this contractual arrangement with the funeral home protects the member. Funds in this type of irrevocable account are not considered as available assets of the member as they are in the name of the funeral home for the designee. Dividends are added to the balance and the funds remain in the community. The funeral home has immediate access to funds upon presenting credit union with death certificate for verification and receipt per contract.

What insurance is right for you?